26 Feb Under the SECURE Act, can I convert to a Roth IRA?

Photo: pixabay.comQ. With the passing of the SECURE Act, is it still possible to convert some of our qualified tax-deferred accounts after we retire to a Roth IRA to bypass the 10-year stretch limit for inherited IRAs?

— Planning

A. Yours is a great question.

Let’s step back for a moment.

The SECURE Act is a new law that stands for Setting Every Community Up for Retirement Enhancement Act of 2019.

One of the big provisions of the act affected inherited IRAs from a non-spouse.

Prior to the SECURE Act, if you inherited a retirement account from someone other than your spouse you could stretch it out over your lifetime, said Bernie Kiely, a certified financial planner and certified public accountant with Kiely Capital Management in Morristown.

“Each year you would be required to withdraw a small amount called your Required Minimum Distribution (RMD),” Kiely said. “You would be required to pay federal and state income taxes on your RMD. But the rest of the inherited IRA would continue to grow tax deferred. This was called a Stretch IRA.”

But under the SECURE Act, all inherited IRAs from a non-spouse must be withdrawn and taxes paid within 10 years of the decedent’s death.

This does not mean that it must be withdrawn over 10 years, he said. You can in fact wait the entire 10 years and withdraw it all on the last day. This 10-year rule also applies to non-spouse inherited Roth IRAs. The funds must be withdrawn, tax-free, by the end of 10 years.

In your question, you use the word “we,” which tells us you’re married and you each have your own retirement accounts.

Kiely said he recommends you and your spouse make each other the primary beneficiaries and your children contingent beneficiaries of your retirement accounts.

Now the question remains: Should you convert your retirement accounts to Roth IRA accounts? Would this benefit yourself, your spouse and your children?

If you convert to a Roth, you will pay more tax now and no tax later.

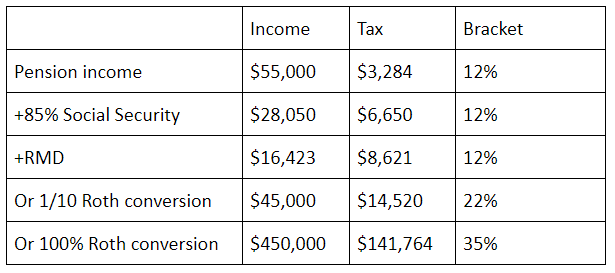

Consider these numbers comparing taxes for a hypothetical couple:

“If this hypothetical couple just took their RMDs, they would stay in the 12% federal tax bracket,” Kiely said. “If instead of taking their RMD they converted their $450,000 IRA to a Roth over 10 years, it would push them into the 22% tax bracket. If they bit the bullet and converted 100% of their IRA to a Roth, they would jump up to the 35% tax bracket.”

Kiely said if you converted 100% of your IRA to a Roth, you would be sending the IRS a check for an additional $133,000.

“If your money could earn 6% each year, the $133,000 in additional taxes would cost you nearly $8,000 lost earnings every year for the rest of your life,” Kiely said. “Think about it. It’s not only taxes, but the money you voluntarily send to the government is no longer working for you.”

Email your questions to .

This story was originally published on Feb. 26, 2020.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.