13 Jan Terror attacks, risk and overseas investing

Photo: talesin/morguefile.comQ. With all the talk of terrorist attacks, I’m nervous about investing overseas and I’m thinking of selling international investments in favor of more U.S. What do you think?

— Nervous

A. The headlines these days do give investors pause.

“The markets don’t like uncertainty, and nothing breeds more uncertainty than the inexplicable unlawful use of force and violence against society,” said John Zeltmann, a certified financial planner with RegentAtlantic in Morristown.

But before you make any decisions, you should ask yourself the following questions:

• What is your relative time horizon? Why are you investing these dollars to begin with?

• What has been the impact historically of recent major terrorist attacks?

• Am I missing out on growth potential if I focus only on U.S. stocks?

First, your time horizon.

Before making asset allocation decisions based off of the probability (or not) of terrorist attacks in non-U.S. countries, you first must identify the goal of the funds you’re investing, Zeltmann said.

If you’re saving for a short-term need such as paying off a mortgage or paying for college, both within the next few years, Zeltmann recommends you don’t expose those funds to any risk at all, domestic or foreign.

“Instead, keep those funds in cash or ultra-short term bonds where you can be sure the principal will be there when you need it,” he said.

On the other end of the spectrum, if you’re saving for retirement, that’s a different story.

“When saving for retirement, one generally has a much longer time horizon, so it’s important to make investment decisions in the context of that time horizon,” he said. “Because the longer the time horizon, the more opportunity there is for equity markets to recover from a major market setback, either induced by a terrorist attack or other significant event.”

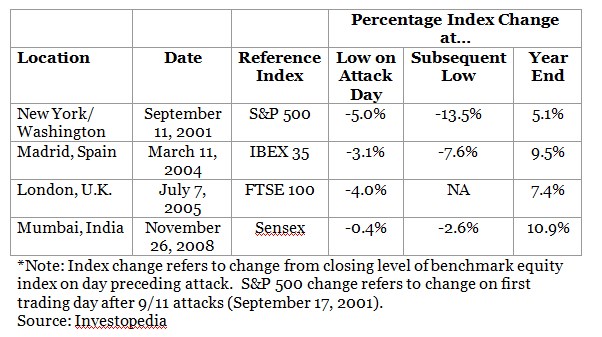

It’s helpful to look at past major terrorist attacks over the past 15 years to provide some perspective on the impact these events have on the equity markets, Zeltmann said.

Take a look at this table:

Zeltmann said the major takeaway is that by the end of the year in which each of the attacks occurred, the home benchmark not only recovered from the initial selloff but also ended up considerably positive compared to the day prior to each attack.

“So while a terrorist attack certainly brings with it some unwelcome volatility, it does not have a lasting impact on equity prices for the longer-term investor,” Zeltmann said.

You also need to consider what growth potential the U.S. offers relative to other parts of the world.

Zeltmann said the U.S. is one of the largest, if not the largest, financial and political superpowers in the world – a point that’s difficult to dispute. However, when looking for economic growth – a major driver of your portfolio’s returns – in the world today, one shouldn’t ignore where the bulk of global economic growth will come from over the next 5, 10, or 20 years – foreign economies, specifically emerging market countries such as Brazil, Russia, China, and India, he said.

“If you’re invested solely in the U.S., you’re missing out on over 80 percent of the world’s GDP and approximately half of the world’s global stock market value,” Zeltmann said. “Over the past 20 to 30 years, we’ve seen a significant shift away from considering the U.S. as the bastion for economic growth and have really started to consider some of the lesser developed countries as being the primary source of growth over long periods of time.”

As these countries work to assemble the appropriate infrastructure to support this growth, Zeltmann said, progress won’t come without some level of volatility. But over the long-run, he said, investments in foreign markets will provide a considerable boost to returns as compared to a portfolio that focuses solely on U.S. stocks.

Jerry Lynch, a certified financial planner with JFL Total Wealth Management in Boonton, says you’re overthinking it.

“You invest for the long term and speculate in the short term,” he said. “If you are thinking long term, I would not be worried at all. Asset allocation is about diversification and you never know what is going to be the hot area or the bad area. Spreading it out reduces your risk.”

Email your questions to .

This story was first posted in January 2016.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.