15 Feb Should I choose a target date fund?

Photo: earl53/morguefile.comQ. I have a diverse portfolio of mutual funds, about 50 percent stocks and 50 percent fixed income. With the recent market drops, would I have been better off in a target-date fund? I’m 54.

— Need help

A. Target-date, or lifestyle funds, are akin to a “set-it and forget-it” type of investment strategy.

Target-date funds have been marketed to investors of all ages. In fact, most employer-sponsored retirement plans offer target-date funds as the default investment for deposits if the employee does not make an investment choice, said Michael Green, a certified financial planner with Wechter Feldman Wealth Management in Parsippany.

“The idea behind target-date funds is to select the fund closest to your desired retirement year,” Green said. “The fund manager implements a glide path to gradually reduce equities and increase bonds, becoming more conservative as you get older.”

That sounds great, but there’s more to consider than your retirement date when you create the portfolio that’s right for you.

Green said an investor’s retirement asset mix should always align with his or her risk tolerance, goals, tax considerations and other constraints. But, he said, target-date funds provide a “one-size-fits-all” allocation strategy that rarely makes sense for the majority of investors.

Since you are age 54, Green said, a 2025 or 2030 target-date fund would probably be your best match.

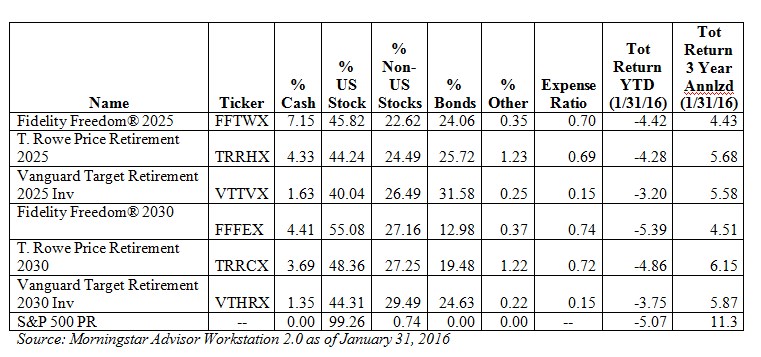

Fidelity, T. Rowe Price, and Vanguard offer 2025 target funds with equity allocations ranging from 66.5 to 68.7 percent. If you were to select from one of their 2030 funds, Green said, your equity exposure would range from 73.8 percent to as high as 79.2 percent.

“Generally speaking, you would not have been better off during recent market drops with a higher equity allocation in comparison to your existing 50/50 diversified portfolio,” Green said.

He offered this chart:

“During the Great Recession in 2008 many target funds fell nearly as much as the S&P 500 index and offered little in the way of protection,” Green said. “Some target-date funds lost over 30 percent of their value while the S&P 500 fell by about 36 percent. This happened despite the fact that they owned both equity and fixed income within the funds.”

Green said a portfolio tailored to your specific goals, risk profile and needs might be a better approach.

You need to ask yourself if in addition to holding more equities than your current portfolio, whether the investments that make up the target-date fund are appropriate for you and the current market environment, he said.

Also ask yourself: Are stocks domestic or international? If international, are they in developed or emerging markets? Are bonds short-term, intermediate, or long? High yield or investment grade?

Instead of going with a target fund, consider speaking with a financial advisor about building a custom-tailored portfolio, Green said.

Email your questions to Ask@NJMoneyHelp.com.

This story was first posted in February 2016.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.