11 Jan Powering forward: Investment outlook for 2021

contributed by Michael S. Cocco, CFP®, ChFC® courtesy of LPL Financial

POWERING FORWARD

More than most years, it’s hard to look ahead to the next year, to 2021, without looking back at 2020. A global pandemic, a massive economic collapse, a bear market, a surprisingly sharp reversal, a hotly contested election where passions ran high, the impact of lockdowns—it was an unusual year of extraordinary challenges.

In 2021 it’s time to restart the engines, but things are going to look different, feel different. 2020 has changed us, the way we do business, the way we connect. It’s also shown us our constants, what works for us, and what we hold on to.

In 2021 we restart the engine, but we’re not driving toward the same world we left behind in 2019. It’s not even our destination. There has been damage to areas of the economy that may never fully recover, but there are other areas that will adapt, reinvent themselves, and help reinvigorate growth. In Outlook 2021: Powering Forward, we talk about stocks and bonds, the economy, and the post-election policy environment, but in the background will be new challenges, new opportunities, and new ways of doing things.

Thankfully, one constant has been the value of personal and professional relationships, even if we’ve had to learn how to connect in new ways. Sound financial advice offered a long-term map for many investors that helped them from getting off course in a turbulent 2020. There are still risks to navigate in 2021, but it’s time to get back on the road.

COVID-19

Over the course of the year, we have seen an increased understanding of how to contain the COVID-19 virus, important progress on how to treat those hospitalized, and promising developments on treatments and potential vaccines. Nevertheless, conditions have worsened heading into late 2020, with a record number of confirmed cases and increased hospitalizations. We believe we will see continued advances in 2021 that will further limit the impact of the virus by the end of the year, but it will be a process. In the meantime, the goal remains keeping the economy as open as possible while making sure that our healthcare system doesn’t get overwhelmed and the most vulnerable are protected.

FORECASTS

Policy. We expect global central banks to remain supportive and for individual economies to continue to refine their responses to COVID-19. In the United States, what will likely be a divided government may help limit the size of any tax hikes and regulation while still supporting additional fiscal stimulus that may include high-priority items for both Democrats and Republicans. We could also see movement toward a similar deal on infrastructure. Greater clarity on trade may make it easier for some companies to do business, but a more challenging regulatory environment may be an offset.

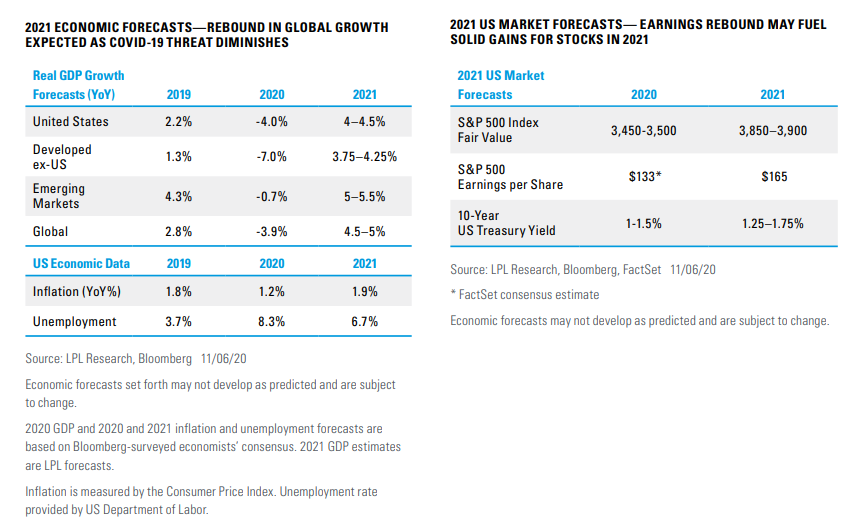

Domestic Economy. Continued progress in the response to COVID-19, including further stimulus, will be the key to sustaining the recovery. COVID-19-impacted service industries may be the last to bounce back. We expect some of the accelerated innovation that came with the COVID-19 response to have a positive long-term impact. We forecast 4–4.5% US gross domestic product (GDP) growth in 2021.

International Economy. Emerging market economies may lead in a global rebound. We believe growth in international developed economies may lag behind the United States, although a strong fiscal response may help Japan. We forecast global GDP growth of 4.5–5%.

Stocks. A strong earnings rebound in 2021 may allow stocks to grow into somewhat elevated valuations. Cost efficiencies achieved during the pandemic may persist. We see an S&P 500 Index fair value target range of 3,850–3,900 in 2021 with potential for upside with better-than-expected vaccine progress.

Bonds. Inflationary pressure is likely to be limited, and the Federal Reserve (Fed) is expected to keep rates low, but economic improvement and even normalizing inflation could put upward pressure on rates. We see the 10-year yield finishing 2021 in a range of 1.25–1.75% with a bias toward the lower end.

THE FED IN THE DRIVER’S SEAT

Current expectations are that the Fed will not raise rates for some time. The median Federal Open Market Committee (FOMC) member “dot plot” forecast doesn’t show an initial rate hike until after 2023. The Fed’s updated policy framework, announced in August 2020, also points to the Fed being on hold for some time. The new framework shifts the Fed’s inflation target from simply 2% to a long-term average of 2%, allowing inflation potentially to run higher if it has run lower for an extended period, as it has in the recent year. In the wake of the Great Recession, the Fed did not raise its policy rate for seven years after lowering it to near 0%.

INFLATION IN THE BACK SEAT

Massive fiscal and monetary stimulus may set the table for a meaningful pickup in inflation down the line, but beliefs were similar in 2009. We believe the near-term inflationary pressures may be limited and that a healthy economy remains a precondition for a meaningful upside surprise in the future. In the near term, slack in the labor market and spare industrial capacity are likely to remain in play at least through 2021, taking some key drivers of inflation out of play.

THE JOURNEY CONTINUES

2020 has been an extraordinary year filled with uncertainty and unexpected challenges that will stay with us for a long time. But looking at 2020 market performance—and ignoring the path to getting there—it was not that unusual a year at all. For longterm investors, 2020 was another year of making steady progress toward long-term investing goals.

2021 may offer similar market performance, although we believe it will offer a smoother path and an economic environment that may simply feel better. Markets are always looking ahead, and even back in March 2020—early in the COVID-19 crisis—they began to respond to the economy and corporate America to power forward, even if the timing was uncertain. Whether we’re looking at earnings or economic data, we’ve exceeded those early expectations to date. 2021 is about continuing to follow that course and maintaining the momentum.

Outlook 2021: Powering Forward was designed to help you navigate a year in which economic conditions may continue to improve dramatically. Understanding the road immediately ahead is essential for navigating its twists and turns, but it will be thoughtful planning and sound financial advice that will keep us on the journey.

Michael Cocco is a CERTIFIED FINANCIAL PLANNER® professional with Beacon Wealth Partners in Nutley. He may be reached at mcocco@beaconwealthpartners.com or (973) 667-8650.

This is a sponsored section. The advisors have paid a fee to post their commentary here. Their sponsorship doesn’t influence any editorial decisions we make at NJMoneyHelp.com, or give them more or less exposure in our stories. Their posting does not constitute an endorsement by NJMoneyHelp.com.