04 Aug My brother died of COVID-19. Does ex-wife get an inheritance?

Photo: pixabay.comQ. My big brother died of COVID-19 and he didn’t have a will. He divorced 20 years ago and has no kids, but his ex is telling me she should get an inheritance. Who has the right to his money?

— Little sister

A. We’re sorry to hear about the loss of your brother.

It’s unlikely that your brother’s ex-wife is entitled to any of his assets.

There are three main ways property can transfer at death and there are different rules for each of them, said Andrew Novick, a certified financial planner and estate planning attorney with The Investment Connection and Brookner Law Offices in Bridgewater.

First, let’s discuss joint assets.

When property is held as “joint tenants with rights of survivorship,” commonly abbreviated as JTWROS, the surviving joint owner — assuming there are two owners — automatically becomes the sole owner of the property, Novick said.

Most commonly, this occurs with bank or brokerage accounts or real estate, he said.

Typically, jointly owned property is retitled into individually owned property after the divorce.

“In the event this was never done, New Jersey law — NJSA 3B:3-14 — automatically changes JTWROS property to a different form of joint ownership, called `tenancy in common,’ when a divorce is finalized,” Novick said. “With tenants in common property, when one owner dies, his/her 50% ownership interest becomes a probate asset and passes pursuant to his/her will or the state’s intestacy laws if there was no will.”

Novick said that means that even if your brother still owned JTWROS property with his ex-wife at the time of his death, she would not automatically inherit his share. Of course, she would retain her own 50% share that she owned all along, he said.

Next, property can pass by beneficiary designation. This is typical for insurance policies or retirement accounts.

Beneficiary designations are typically updated after a divorce, Novick said, but New Jersey law revokes a divorced spouse as beneficiary even if the beneficiary designation was never updated, Novick said. So in this case, even if your brother designated his wife as a beneficiary on an insurance policy or retirement accounts and never changed it, she would not be able to enforce it.

The third way property can pass is through a process known as “probate.”

Probate is guided by a will, and if there was no will, it would be guided by the state’s intestacy laws.

“Your brother didn’t have a will, but even if he did, any property left to his spouse is voided by New Jersey law when they got divorced,” he said. “Since your brother didn’t have a will, New Jersey intestacy statutes apply.”

Novick said an ex-spouse is never entitled to inherit property under the intestate statutes.

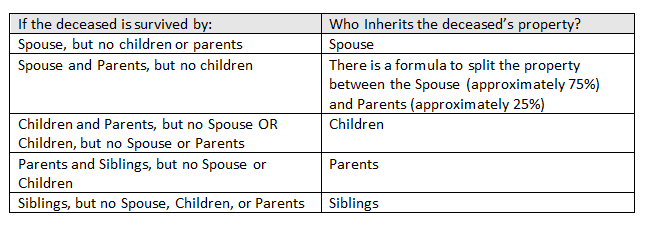

This table summarizes the most common situations.

Novick said there are two important caveats for the above rules.

“First, they can be superseded by a divorce decree,” he said. “Thus, you will need to read your brother’s divorce decree to see whether it has any relevant language.”

Second, the rules apply to ownership, beneficiary designations or wills that arose during the marriage. Anything that happened after the marriage would not be impacted by the divorce, Novick said.

Email your questions to .

This story was originally published on Aug. 4, 2020.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.