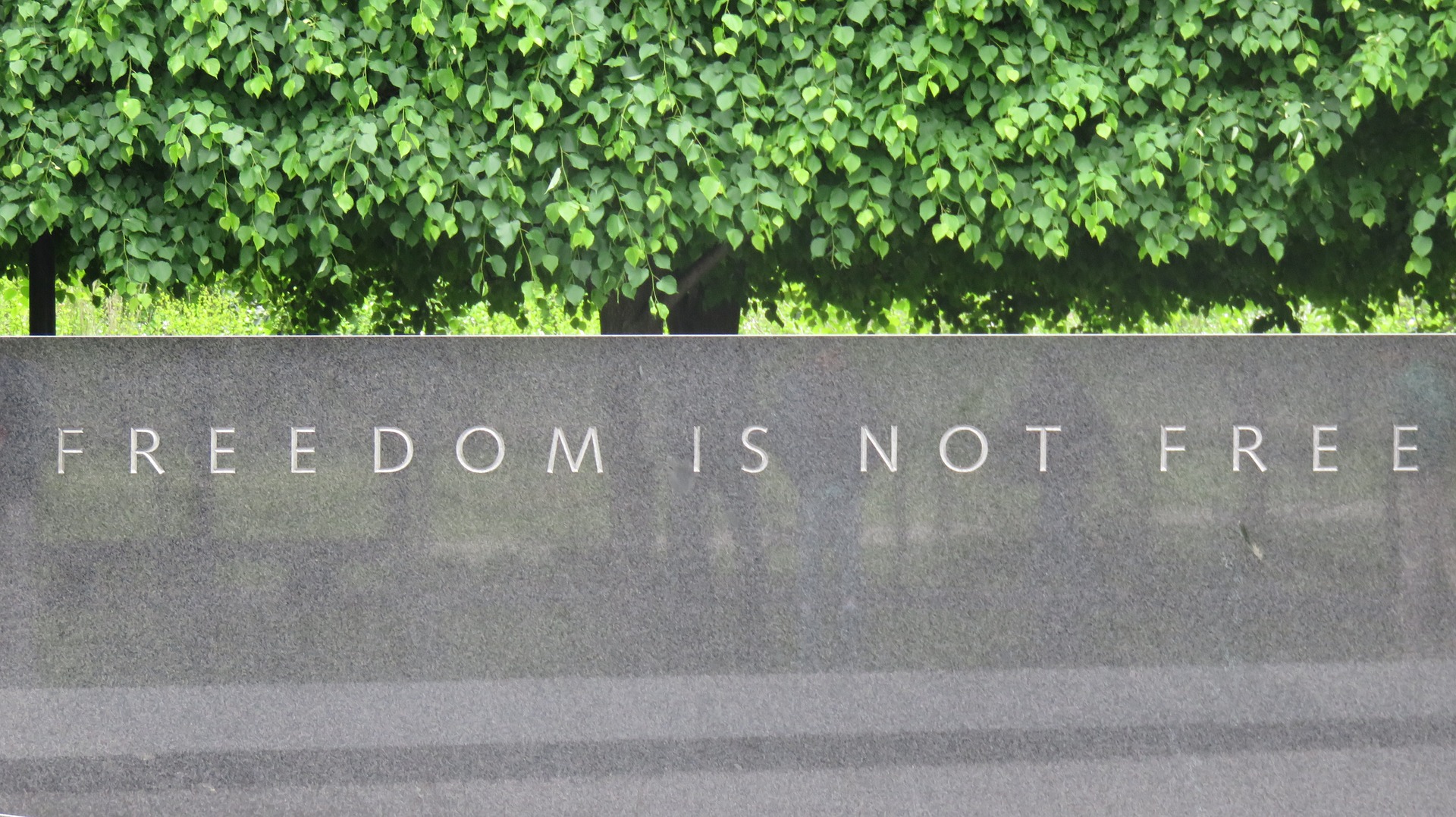

08 Jul Why aren’t there more N.J. tax breaks for veterans?

Photo: pixabay.comQ. My husband is a Vietnam War veteran. Of course he gets the tiny $250 tax reduction since 1980. How can it be only $250 after 49 years? This is an affront to our military veterans. Can’t we do better?

— Proud wife

A. Thanks to your husband for his service.

There are actually two real estate tax deductions for veterans who live in New Jersey.

The first, as you mentioned, is the $250 property tax deduction.

This law, N.J.S.A. 54:4-8.11, was first enacted in 1963, then amended in 1985 and amended again in 2000, said Bernie Kiely, a certified financial planner and certified public accountant with Kiely Capital Management in Morristown.

The 2000 amendment states that the deduction will be $100 in tax year 2000, $150 in tax year 2001, $200 in tax year 2002 and $250 in subsequent tax years.

“To be eligible for this deduction, the person must be a resident of New Jersey, honorably discharged from active duty in time of war from any branch of the armed forces,” Kiely said. “This deduction is also available to a surviving spouse, unlike the $3,000 income tax exemption which is available only to the veteran.”

You can read more about the $3,000 income tax deduction, which was passed back with the gas tax bill, here.

To apply for the real estate deduction the veteran must complete Form V.S.S. This form lists all the dates that are considered times of war.

The second real estate tax benefit for veterans is a full real estate tax exemption for disabled war veterans, Kiely said.

If you or your spouse are 100 percent disabled war veterans who were honorably discharged and who sustained the injury while on active duty in the U.S. armed forces through enemy action, accident or disease, you are eligible for this benefit, he said.

“It’s true that $250 is not much of a benefit for veterans who served in combat. But those of us who served in combat – I was in the Navy in Vietnam – did not do so for a real estate tax deduction,” Kiely said. “We did it to serve our country and for the VA benefits when we returned. I got a GI mortgage to buy my first home and I went to college and graduate school on the GI Bill.”

Email your questions to Ask@NJMoneyHelp.com.

This story was originally published on July 8, 2019.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.