20 Sep Taxes on income from a side business

Photo: dhester/morguefile.comQ. How much income does my side business need to make before I claim it on my taxes?

— Working on the side

A. We’re glad you asked.

We’d hate to see you get in trouble with the IRS.

If you are a are a U.S. citizen or resident, whether you must file a federal tax return depends on three factors, said Gerard Papetti, a certified financial planner and certified public accountant with U.S. Financial Services in Fairfield.

Those three factors are your gross income, your filing status and your age.

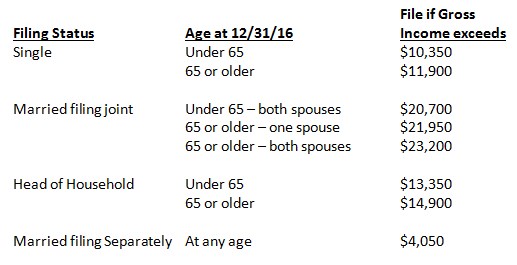

Papetti offered this chart of income limits for each filing status for 2016:

There are also special rules for self-employed persons, Papetti said. You are considered self-employed if you carry on a trade or business as a sole proprietor, if you are an independent contractor, if you are a member of a partnership, or if you are in business for yourself in any other way.

“Self-employment can include work in addition to your regular full-time business activities, such as certain part-time work you do at home or in addition to your regular job,” Papetti said. “Therefore you must file a return if the gross income from your side business is at least as much as the filing requirement amount for your filing status and age shown in the table above.”

Also, Papetti said, you must file Form 1040 and Schedule SE (Form 1040), Self-Employment Tax, if your net earnings from self-employment (excluding church employee income) were $400 or more.

He said schedule SE (Form 1040) is used to compute your self-employment tax.

“Self-employment tax is comparable to the Social Security and Medicare tax withheld from an employee’s wages,” he said.

Email your questions to .

This post was first published in September 2016.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.