21 Mar Smart tips for your first job

Photo: gracey/morguefile.comQ. My daughter just got her first job, and I want to give her good advice to get started with saving. What should I suggest to her?

— Mom

A. Congratulations to your daughter!

We love that you want to help her move in the right direction with her money.

Starting a first job is a milestone into adulthood. As exciting as this can be, it is time for your daughter to think about where she sees herself in the future and the goals she wants to accomplish.

A major component to future success is establishing good financial habits now and sticking to them to benefit you throughout your career and into your retirement, said Clare Wherley, a certified financial planner and certified public accountant with Lassus Wherley in New Providence

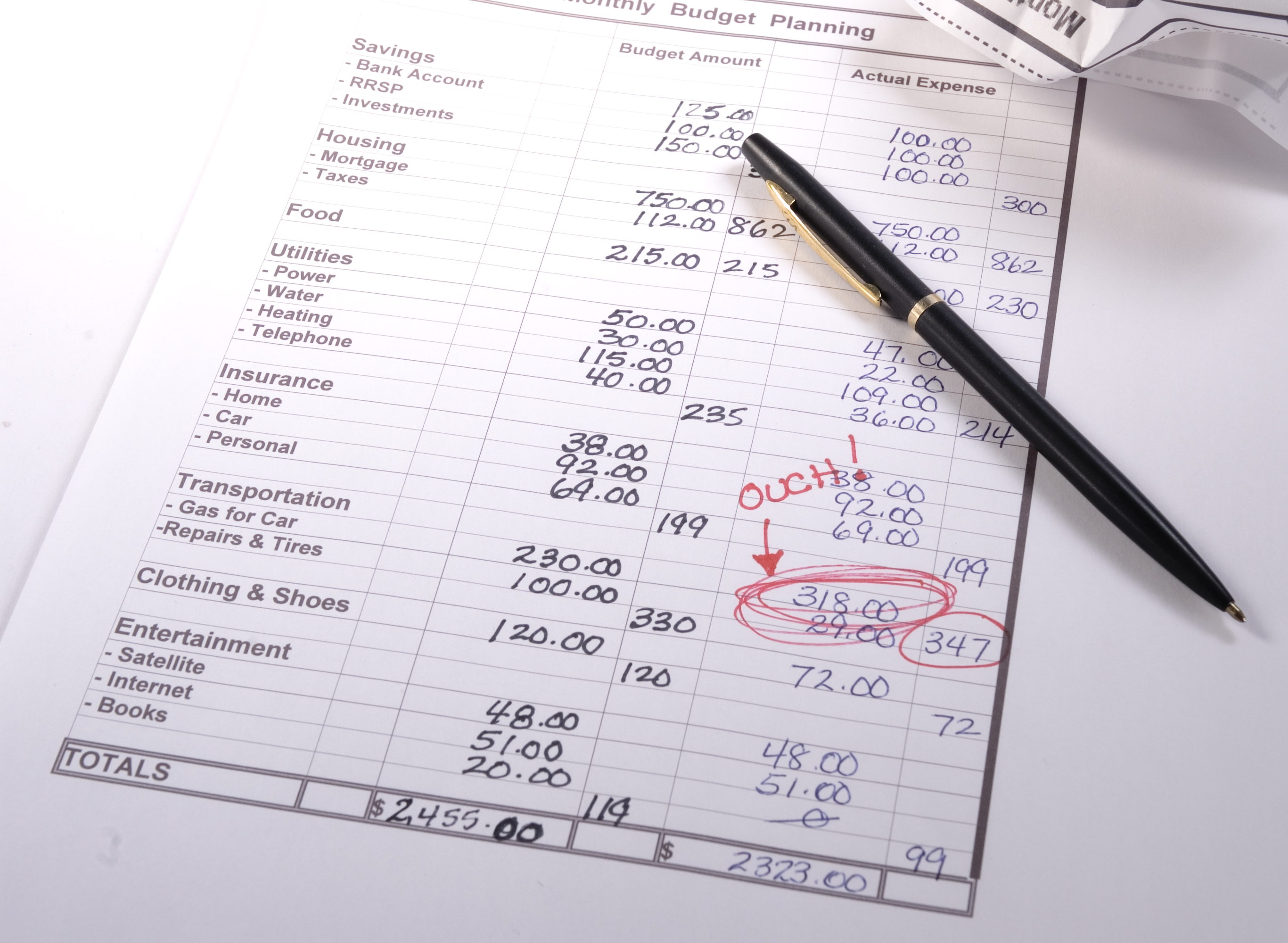

“While saving is personal, and every person has different financial circumstances, developing a budget and starting to save now can help you take charge of your financial future,” she said.

A budget will help her understand her cash flow needs and see what’s available for savings, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge.

Mott said there are a variety of apps and online tools available to help track spending. She may want to consider Mint.com, a program provided by her bank, a spreadsheet or pencil and paper.

“Regardless, it’s important to know the bills she is responsible for each month and how that compares to her income,” Mott said. “If she finds that money is accumulating in her bank account each month, it would indicate that she has the extra cash needed to fund savings goals.”

Once she understands what she could be saving, the next step would be to make a list of what she’d like to save for. Her goals might include a down payment for a car or a home, a great vacation or a wedding, but she needs to also include retirement and an emergency fund on that list, Mott said.

Before the savings start, she should consider any debt she has.

Wherley said she should try paying off the balances with the highest interest rates first.

The sooner the debt is paid off, the more you will be able to save, then going forward, she should avoid carrying credit card balances.

“Commit to paying off your balances in full each month and avoid paying unnecessary fees and interest charges that prevent you from saving more,” Wherley said.

Then it’s time to build an emergency savings account. Wherley suggests starting with a goal of stashing away a fund worth three months of her monthly expenses. This way if she loses her job, she can continue to pay her obligations.

Your daughter should also start thinking long-term.

While retirement may seem to be in the distant future for someone who has just started working, now is a great time to start saving.

Her job probably doesn’t offer a pension to provide support in the future, so Mott said it’s important for Millennials — those born from the early 1982 to mid-2000s — to understand that they will need to provide for themselves when they enter retirement.

“Although that day may seem like a long way off for someone in their 20s and can be put off until later, starting early is the best way to ensure that the nest egg they need is there when they retire,” Mott said. “Therefore, taking advantage of an employer-sponsored retirement plan or individual IRA should be a top savings priority.”

Mott said if your daughter’s employer offers a pre-tax retirement plan such as a 401(k) or 403(b), she’ll want to know whether they also provide a matching contribution based on the employee’s participation and how much she’d need to save each pay period to qualify for it. An employer-match is “free money” that she shouldn’t pass up if at all possible.

“With that number in mind, she can compare it to her extra cash flow to see how it fits into her budget and can set up her contribution accordingly,” Mott said. “It may be some time before she is able to reach the full-year contribution limit, which is $18,000 for 2016, but the pre-tax contribution will also provide some tax savings for her as well.”

If her employer doesn’t offer a company plan, she should make contributions to an IRA, Wherley said, and she should automate her savings.

“A Roth IRA would be preferable because even though the contributions are not deductible, the assets will grow tax-free,” she said.

The maximum IRA contribution for 2016 is $5,500 for individuals under the age of 49.

Email your questions to .

This story was first posted in March 2016.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.